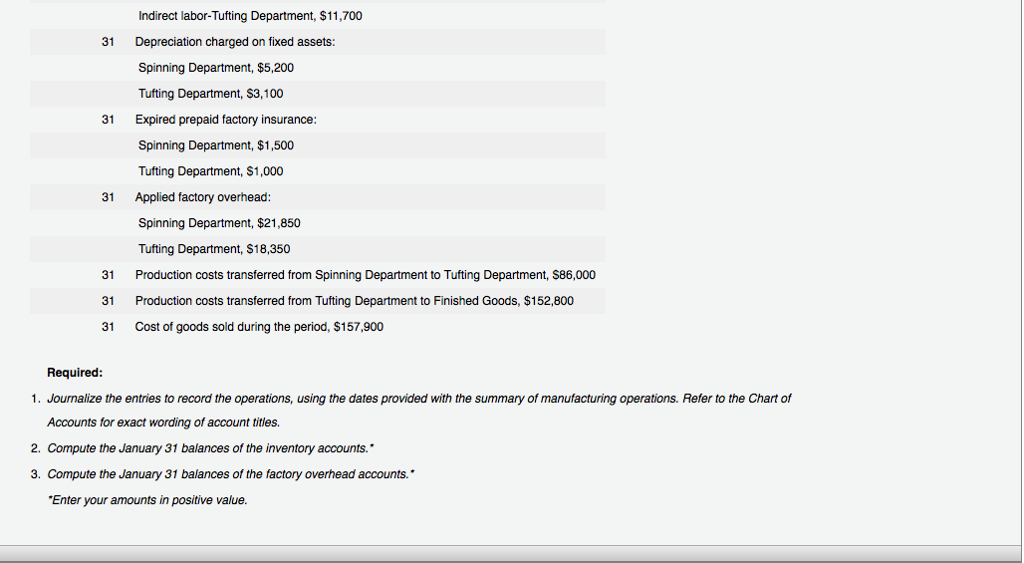

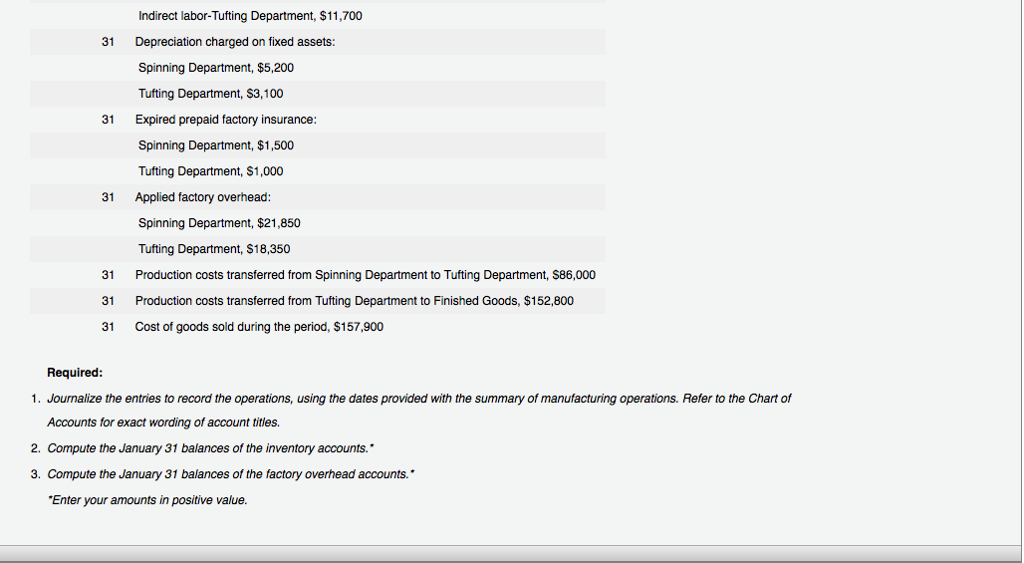

Carpet life years remaining.

Depreciated value carpet.

Every year you take a write off for the amount that you.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Residential rental property is depreciated at a rate of 3 636 each year for 27 5 years.

Normal wear and tear.

Carpets are normally depreciated over 5 years this applies however only to carpets that are tacked down.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

10 years depreciation charge 1 000 10.

Expected life of carpet.

Tile hardwood linoleum unlike carpeting are usually more or.

Only the value of buildings can be depreciated.

By convention most u s.

Original cost of carpet.

2 years 100 per year 200.

Beyond that distinction depreciating carpeting is the same as depreciating a new appliance see the more detailed appliance depreciation article above.

Value of 2 years carpet life remaining.

You cannot depreciate land.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Most other types of flooring i e.

10 years 8 years 2 years.